Streamline with Powerful AI for AML & Fraud Prevention

Case Management AI Agent

Investigation AI Assistant

Regulatory Reporting AI Agent

Adverse Media Search AI Agent

AI-Powered SAR Narrative Generation

AI-Powered Network Diagram Analysis

AI Powered Alert Prioritization

AI-Powered Real-Time Intradiction

Intelligent Automation & Rule Optimization

Skylight’s AI technology is designed to enhance every layer of your compliance and risk programs—across AML, fraud detection, case management, and customer risk rating. Our platform combines AI agents, generative AI, and advanced machine learning to help teams work faster, smarter, and with greater confidence.

AI Agents

Agentic AI that executes key compliance tasks with minimal manual input, improving speed, accuracy, and consistency across workflows.

-

- Case Management AI Agent: Autonomous agent handles the majority of case processing across the complete case lifecycle–from alert to resolution, requiring human intervention only for final decisions.

- Investigation AI Assistant: Comprehensive AI support for case investigations that provides instant access to regulatory knowledge and case insights, reducing investigation time.

- Regulatory Reporting AI Agent: Automated generation and filing of regulatory reports with compliance validation, helping you eliminate manual report preparation errors.

- Adverse Media Search AI Agent: Automated customer background research and risk assessment reduces manual due diligence time from hours to minutes.

AI-Powered Network Diagram Analysis

AI-driven visualizations that uncover hidden relationships and risk patterns across entities and transactions, enhancing investigative clarity.

-

- Transaction Network Analysis: Visual network analysis revealing hidden transaction patterns, relationships, and complex money laundering networks that traditional analysis might miss.

- Risk Propagation Analysis: Advanced modeling of how risk spreads through entity networks, identifying indirect risks that traditional scoring methods cannot detect.

Generative AI

Language models that accelerate documentation and reporting workflows while maintaining compliance and oversight, reducing manual effort and improving consistency across your operations.

-

- AI-Powered SAR Narrative Generation: Reduces SAR writing time while maintaining regulatory compliance and analyst oversight.

- Smart Response Templates: Context-aware response generation for regulatory inquiries, ensuring consistent and compliant responses while significantly reducing response preparation time.

- Document Classification: Automated categorization and processing of compliance documents, eliminating manual document sorting to ensure consistent categorization and faster case processing.

Machine Learning Models

Deliver powerful insights by analyzing patterns, scoring risk, and optimizing decision-making. These models evolve with your data, helping you stay ahead of emerging threats and reduce false positives.

-

- AI-Powered Alert Prioritization / Triage: Leverage our powerful machine learning models to prioritize alerts that are the highest-risk or most likely to be elevated to regulatory filings.

- Supervised Machine Learning: Custom machine learning models help spot hidden patterns in your data, making it easier to detect and prevent fraud. By analyzing cases and scoring risks accurately, they keep you one step ahead.

- AI-Powered Anomaly Detection: Spot unusual patterns in transactions and behaviors, revealing risks outside traditional scenarios and helping your team uncover new risks before they take hold.

- AI-Powered Real-Time Interdiction: Risk score for every transaction in real time with customized machine learning models that deliver highly-accurate, context-driven scores.

- AI-Powered Rule Optimization: Combine machine learning with rules-based systems for accurate risk scoring and decision-making that evolves alongside your needs.

- Intelligent Automation: Accelerate your decision-making by automating routine approvals or rejections, and streamline investigations to boost efficiency across your team.

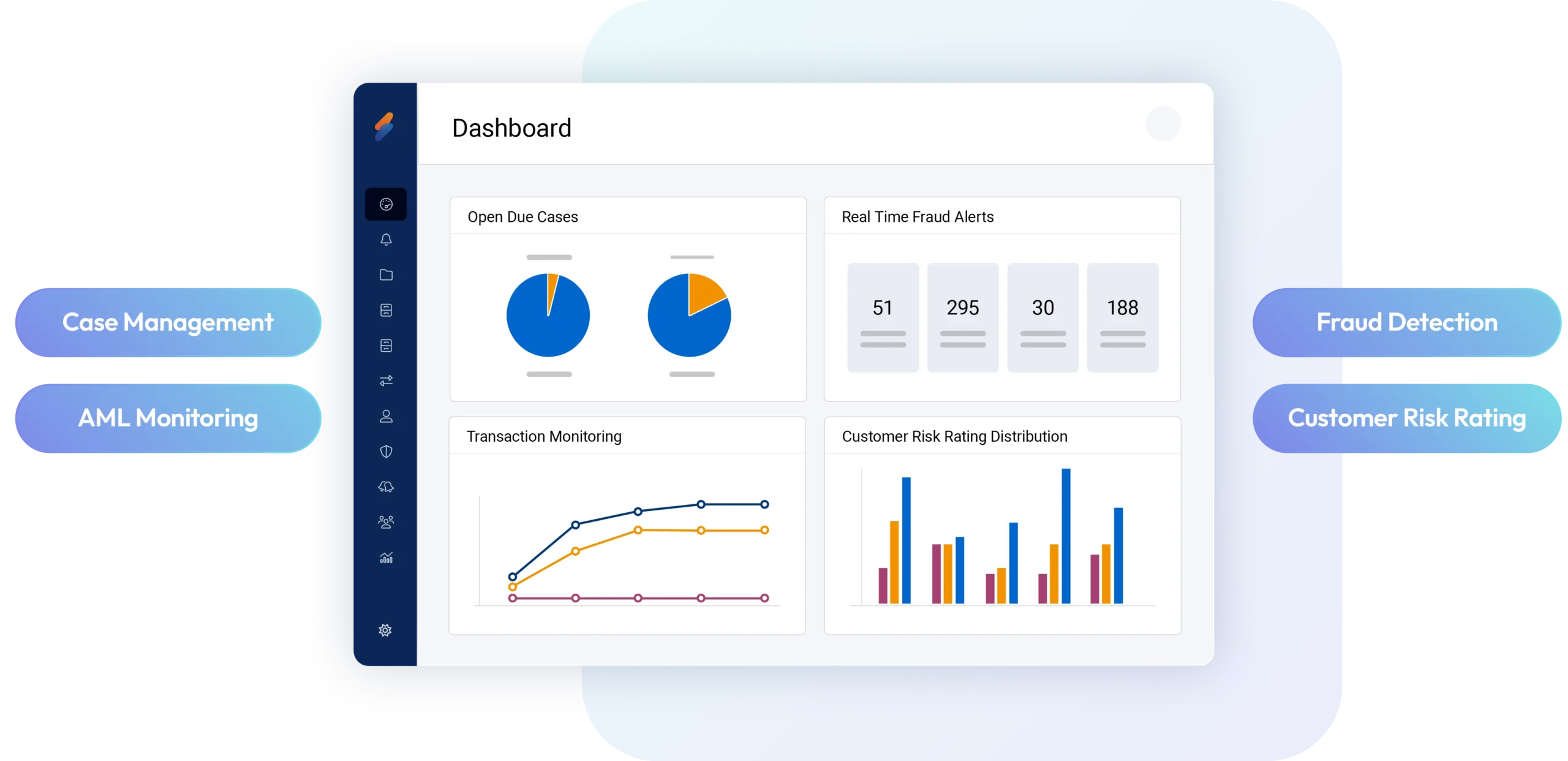

Modules

Learn more about our comprehensive offering

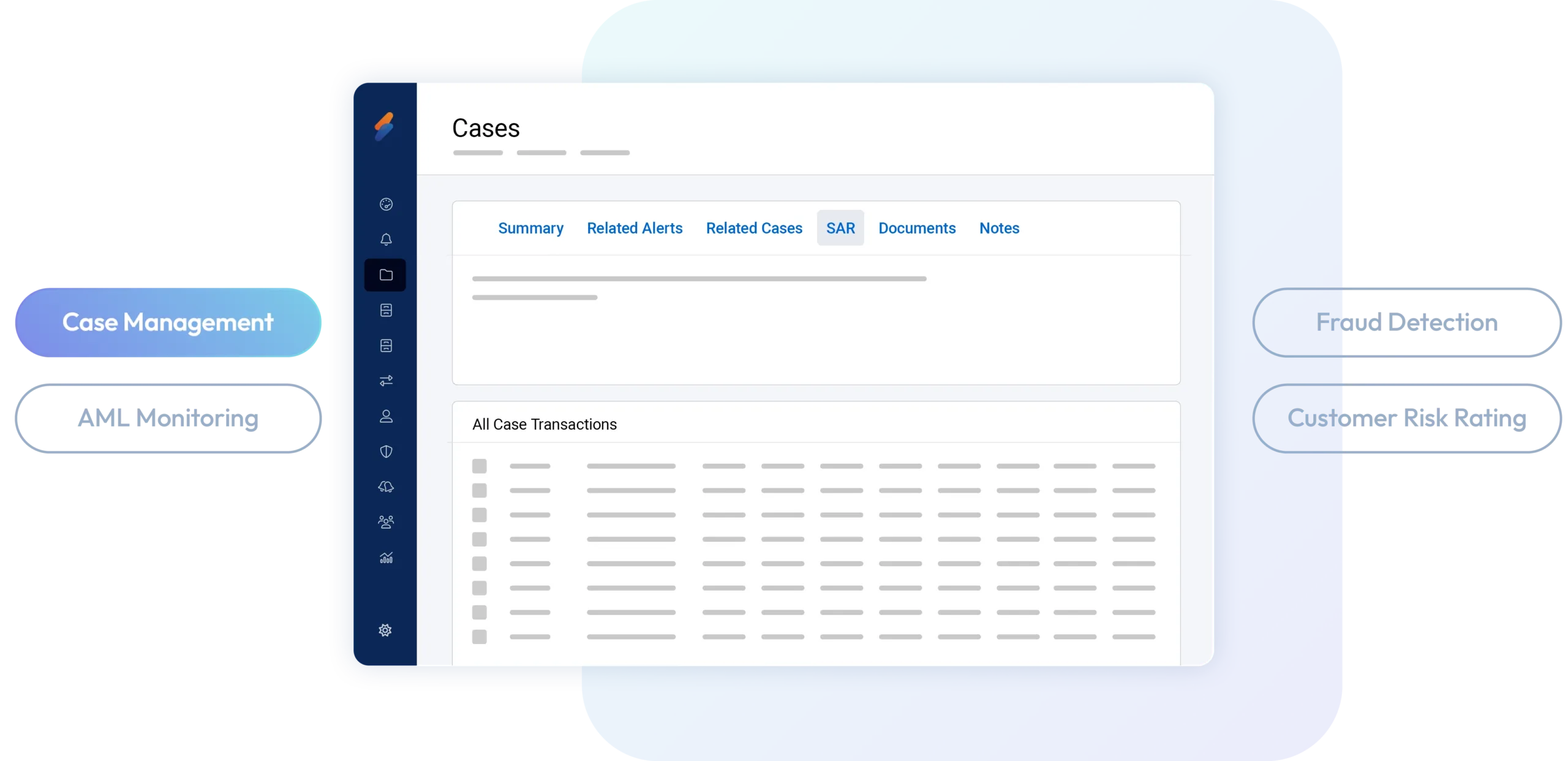

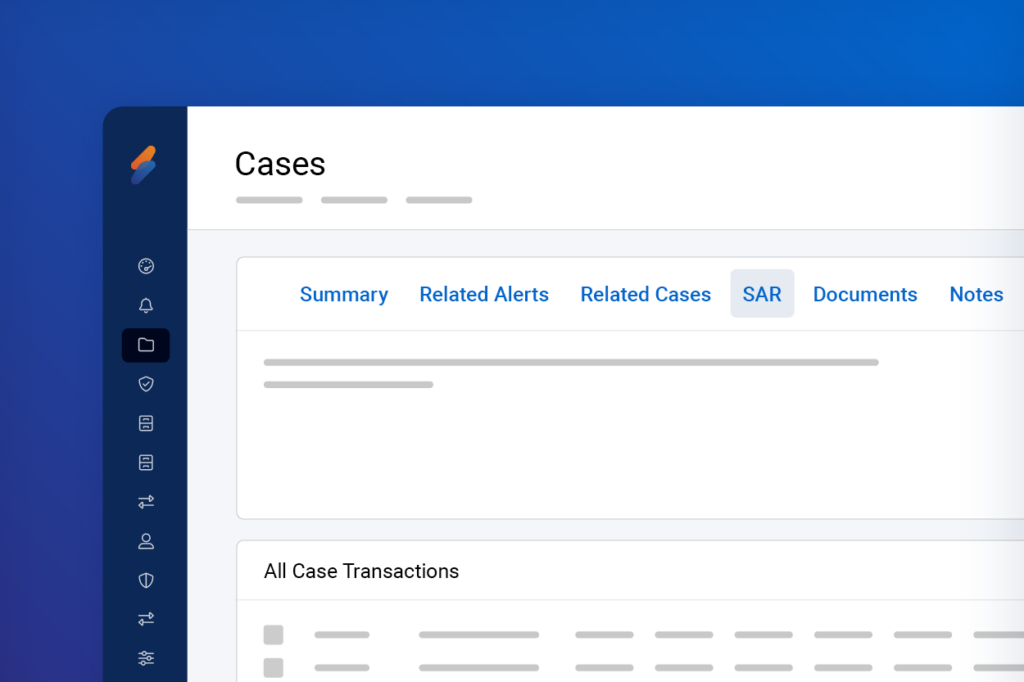

End-to End-Case Management

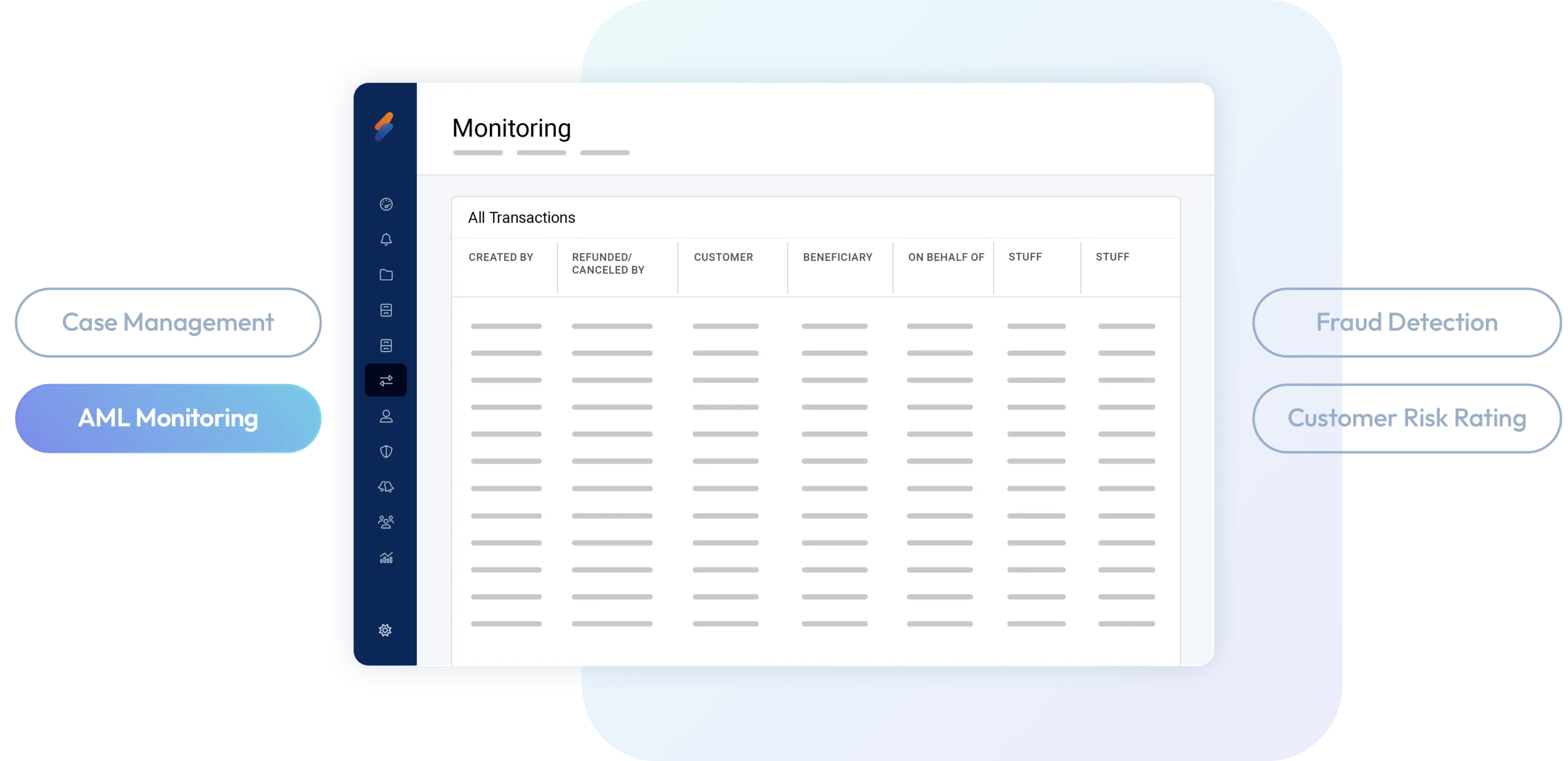

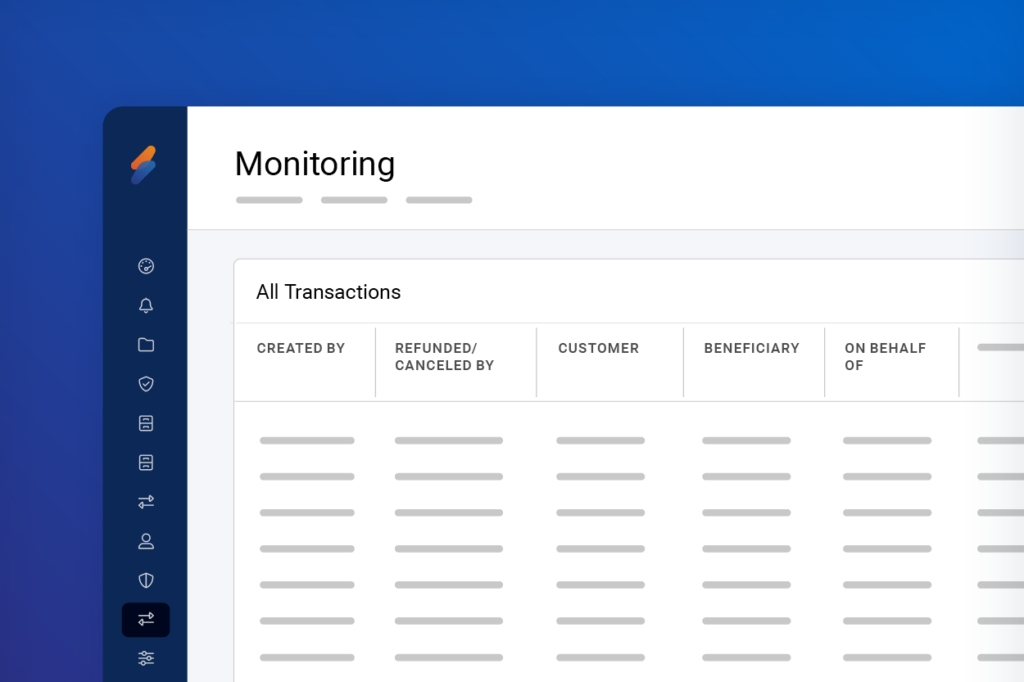

AML Transaction Monitoring

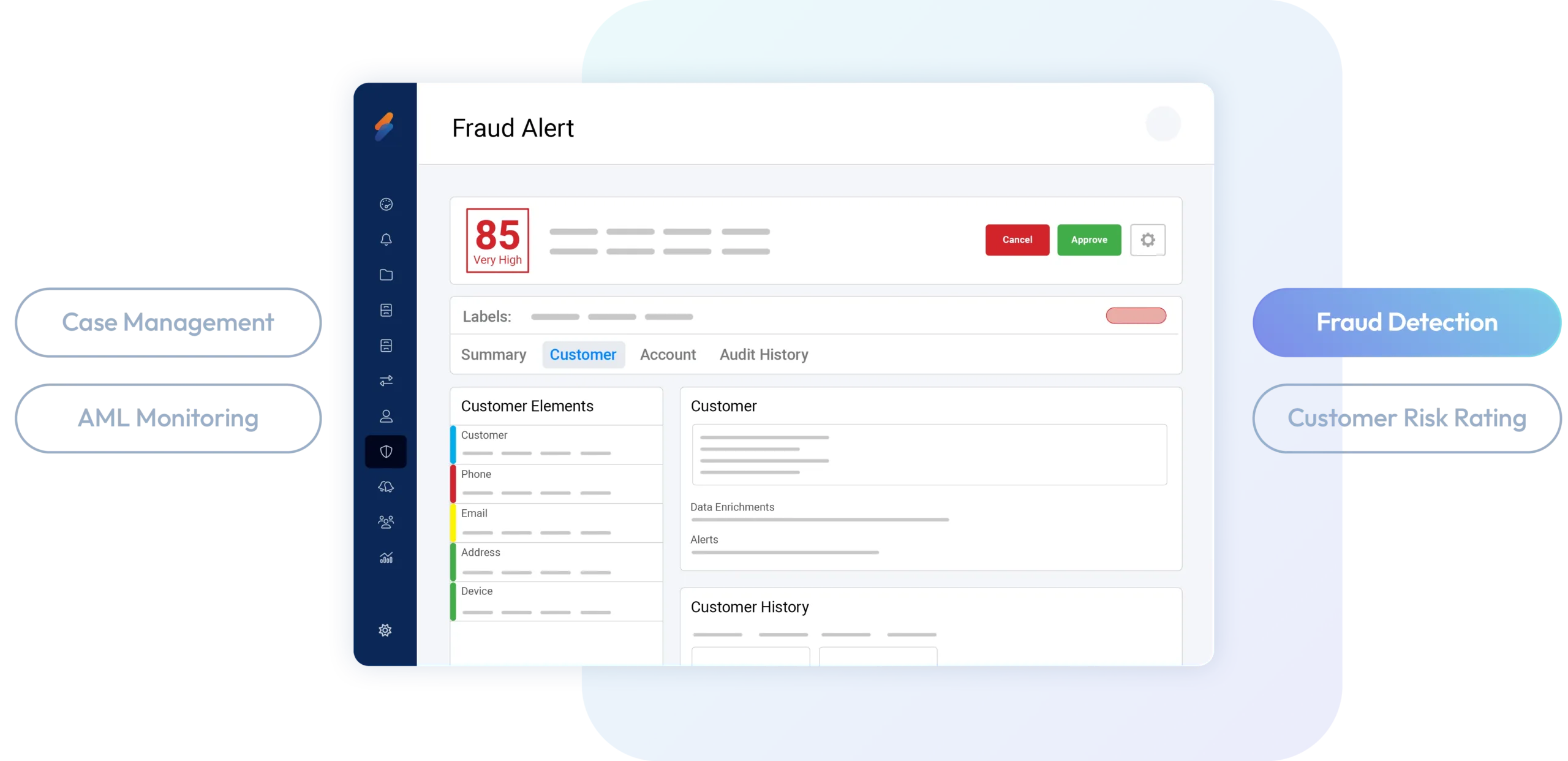

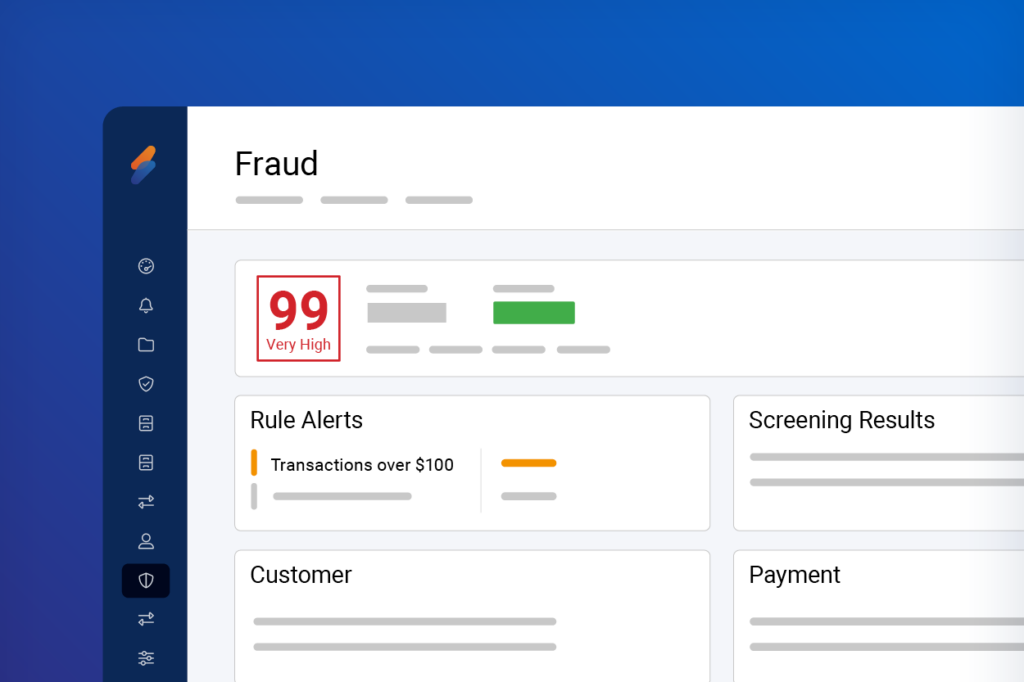

Real-Time Fraud Detection

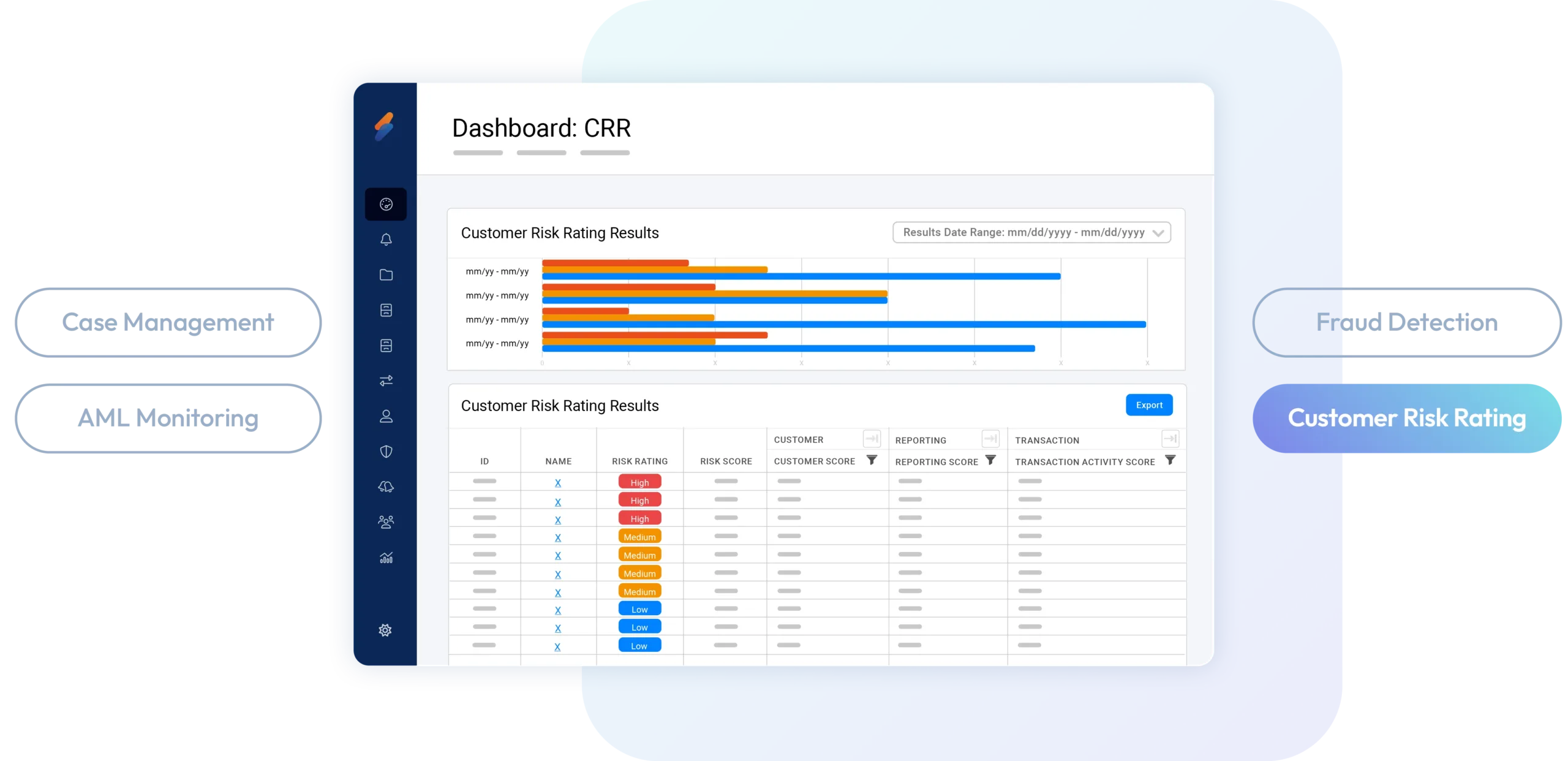

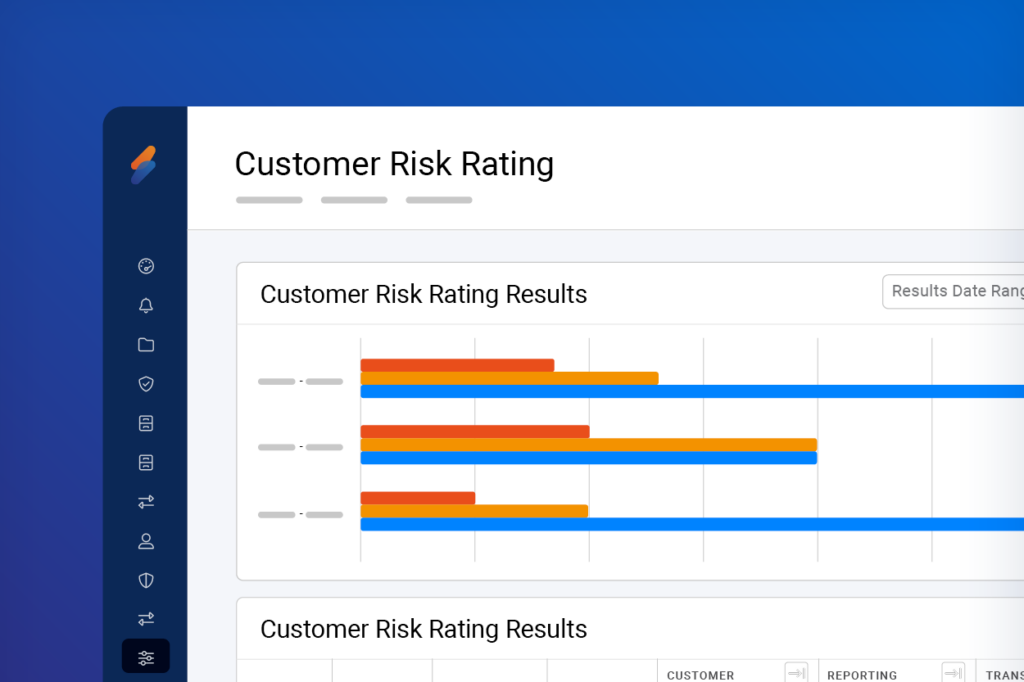

Customer Risk Rating

Streamline with Powerful AI for AML & Fraud Prevention Programs

Get to know Skylight’s Artificial Intelligence

Skylight’s AI technology is designed to enhance every layer of your compliance and risk programs—across AML, fraud detection, case management, and customer risk rating. Our platform combines AI agents, generative AI, and advanced machine learning to help teams work faster, smarter, and with greater confidence.

AI Agents

Agentic AI that executes key compliance tasks with minimal manual input, improving speed, accuracy, and consistency across workflows.

-

- Case Management AI Agent: Autonomous agent handles the majority of case processing across the complete case lifecycle–from alert to resolution, requiring human intervention only for final decisions.

- Investigation AI Assistant: Comprehensive AI support for case investigations that provides instant access to regulatory knowledge and case insights, reducing investigation time.

- Regulatory Reporting AI Agent: Automated generation and filing of regulatory reports with compliance validation, helping you eliminate manual report preparation errors.

- Adverse Media Search AI Agent: Automated customer background research and risk assessment reduces manual due diligence time from hours to minutes.

AI-Powered Network Diagram Analysis

AI-driven visualizations that uncover hidden relationships and risk patterns across entities and transactions, enhancing investigative clarity.

-

- Transaction Network Analysis: Visual network analysis revealing hidden transaction patterns, relationships, and complex money laundering networks that traditional analysis might miss.

- Risk Propagation Analysis: Advanced modeling of how risk spreads through entity networks, identifying indirect risks that traditional scoring methods cannot detect.

Generative AI

Language models that accelerate documentation and reporting workflows while maintaining compliance and oversight, reducing manual effort and improving consistency across your operations.

-

- AI-Powered SAR Narrative Generation: Reduces SAR writing time while maintaining regulatory compliance and analyst oversight.

- Smart Response Templates: Context-aware response generation for regulatory inquiries, ensuring consistent and compliant responses while significantly reducing response preparation time.

- Document Classification: Automated categorization and processing of compliance documents, eliminating manual document sorting to ensure consistent categorization and faster case processing.

Machine Learning Models

Deliver powerful insights by analyzing patterns, scoring risk, and optimizing decision-making. These models evolve with your data, helping you stay ahead of emerging threats and reduce false positives.

-

- AI-Powered Alert Prioritization / Triage: Leverage our powerful machine learning models to prioritize alerts that are the highest-risk or most likely to be elevated to regulatory filings.

- Supervised Machine Learning: Custom machine learning models help spot hidden patterns in your data, making it easier to detect and prevent fraud. By analyzing cases and scoring risks accurately, they keep you one step ahead.

- AI-Powered Anomaly Detection: Spot unusual patterns in transactions and behaviors, revealing risks outside traditional scenarios and helping your team uncover new risks before they take hold.

- AI-Powered Real-Time Interdiction: Risk score for every transaction in real time with customized machine learning models that deliver highly-accurate, context-driven scores.

- AI-Powered Rule Optimization: Combine machine learning with rules-based systems for accurate risk scoring and decision-making that evolves alongside your needs.

- Intelligent Automation: Accelerate your decision-making by automating routine approvals or rejections, and streamline investigations to boost efficiency across your team.

Contact Us t

Case Management AI Agent

Investigation AI Assistant

Regulatory Reporting AI Agent

Adverse Media Search AI Agent

AI-Powered SAR Narrative Generation

AI-Powered Network Diagram Analysis

AI Powered Alert Prioritization

AI-Powered Real-Time Intradiction

Intelligent Automation & Rule Optimization

How it works

Combat financial crime with a flexible infrastructure