End-to-End

Streamline every stage of the fraud and AML case management lifecycle—from initial input and response to in-depth investigation, oversight, reporting, and audit. Enhance your efficiency with powerful AI technology, full regulatory e-filing, and comprehensive quality assurance features.

Powerful Artificial Intelligence

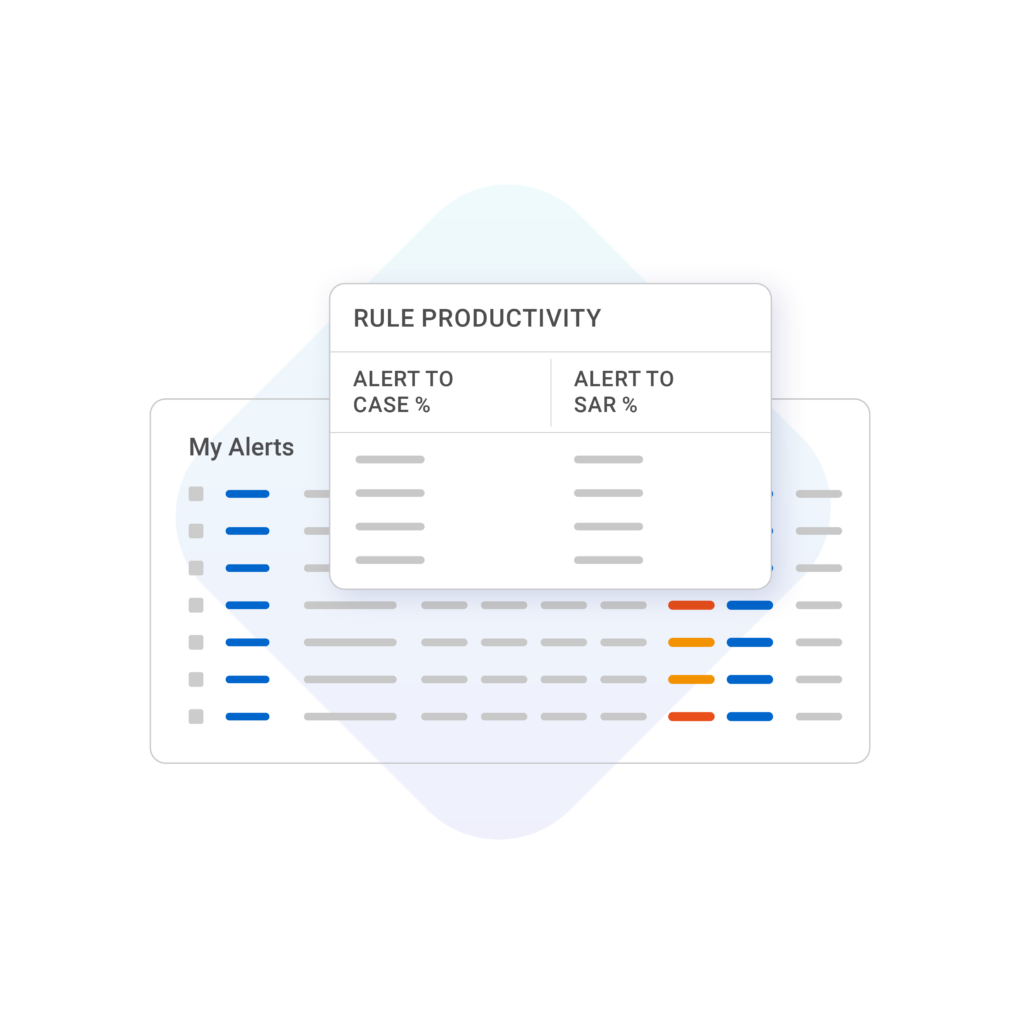

Streamline your compliance and risk efforts with AI

Alert Aggregation

Save time by consolidating related alerts into a single notification

Full e-Filing Capabilities

Streamline reporting by filing directly within the platform

Internal Referrals

Remove silos across your organization

Highly Configurable UI

Flexible Settings

Adjust system configurations with ease

Get unparalleled flexibility and configurable settings for user management, due date calculations, quality assurance flows, secondary approvals for regulatory filing submissions, and more.

Set up secondary approval processes to ensure filings are reviewed and approved according to your internal procedures prior to submitting to regulatory agencies

Enhance efficiency with flexible automation features, eliminating manual tasks for routine processes.

For example, Skylight can automatically determine when a CTR is required and seamlessly file it with FinCen, bypassing the need for your team to manually review alerts, open cases, and submit CTR reports.

Set up global, individual, and work item-based QA settings.

Multi-layered QA workflows are available.

Define your system user roles to align with your unique team structure. Effortlessly set up and manage users with Skylight’s flexible permission settings.

Create and embed checklists as part of Skylight’s quality assurance features. Define a list of program elements for your analysts to complete before a specified action is taken to help refine your processes and minimize case rework.

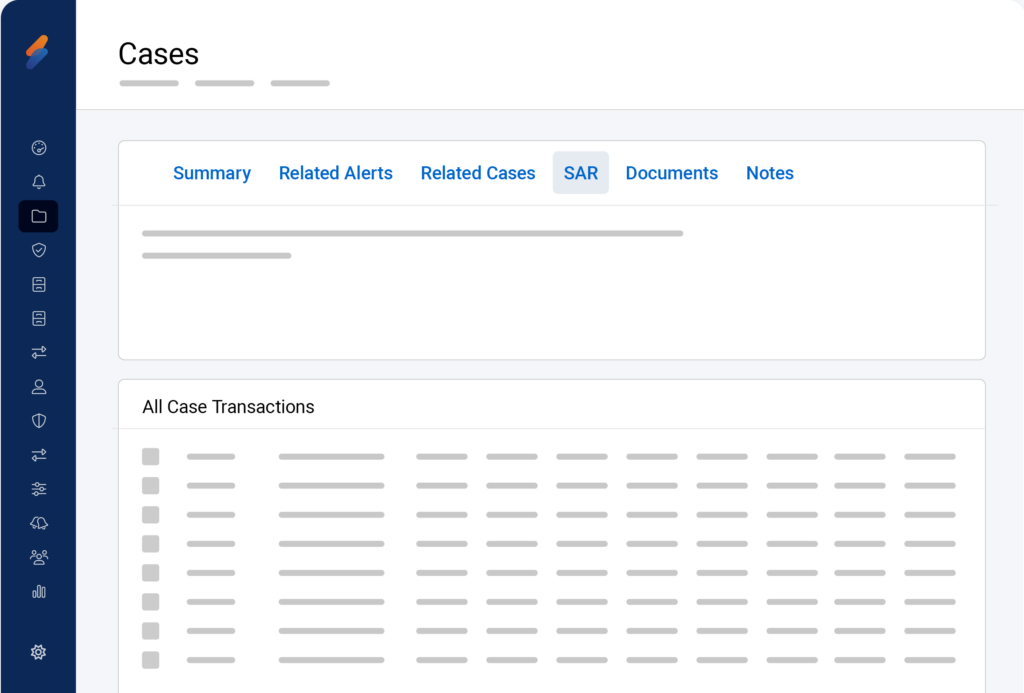

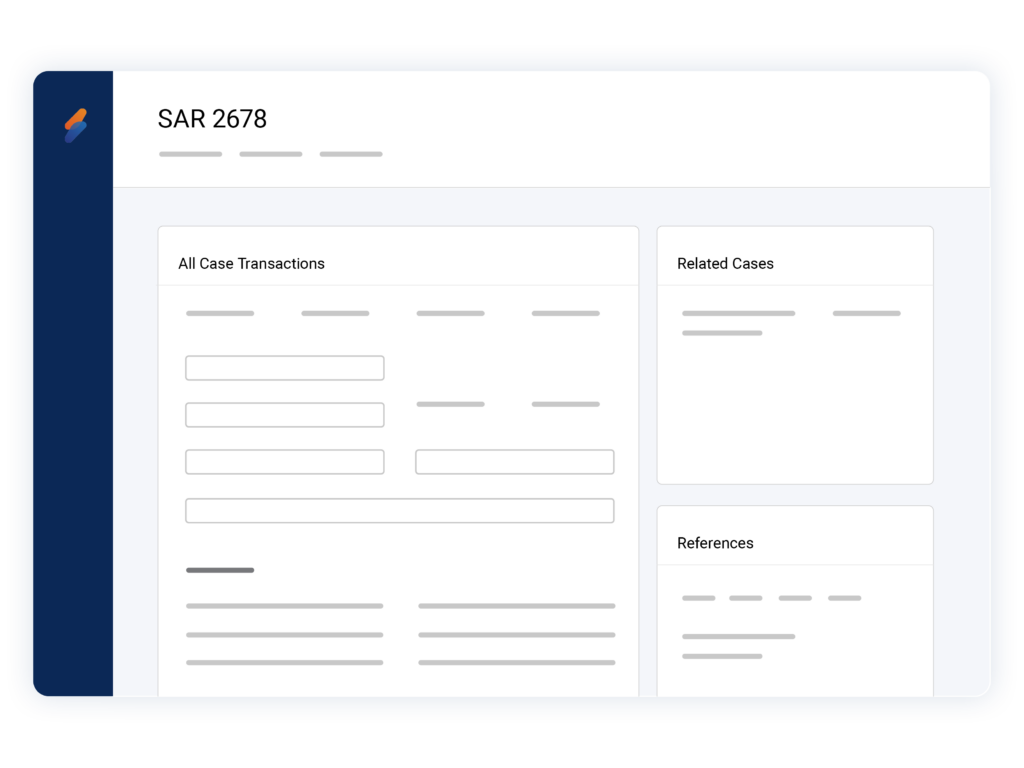

User-Interface

Easily view all data related to your cases in a single screen

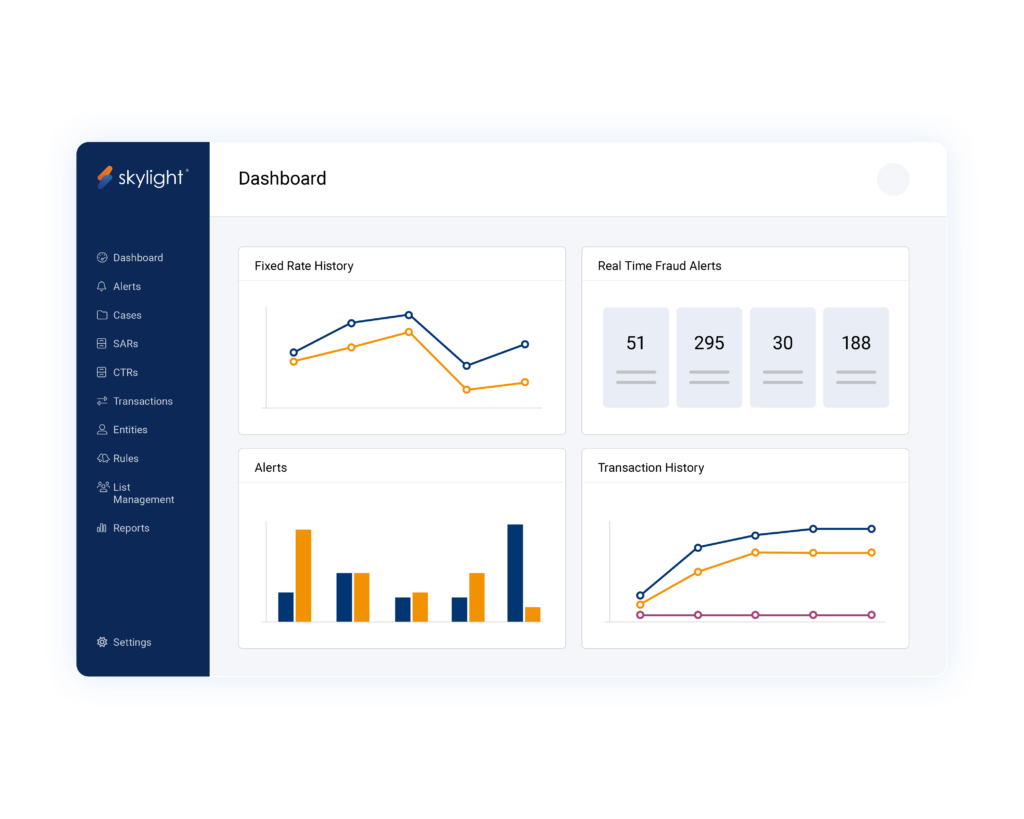

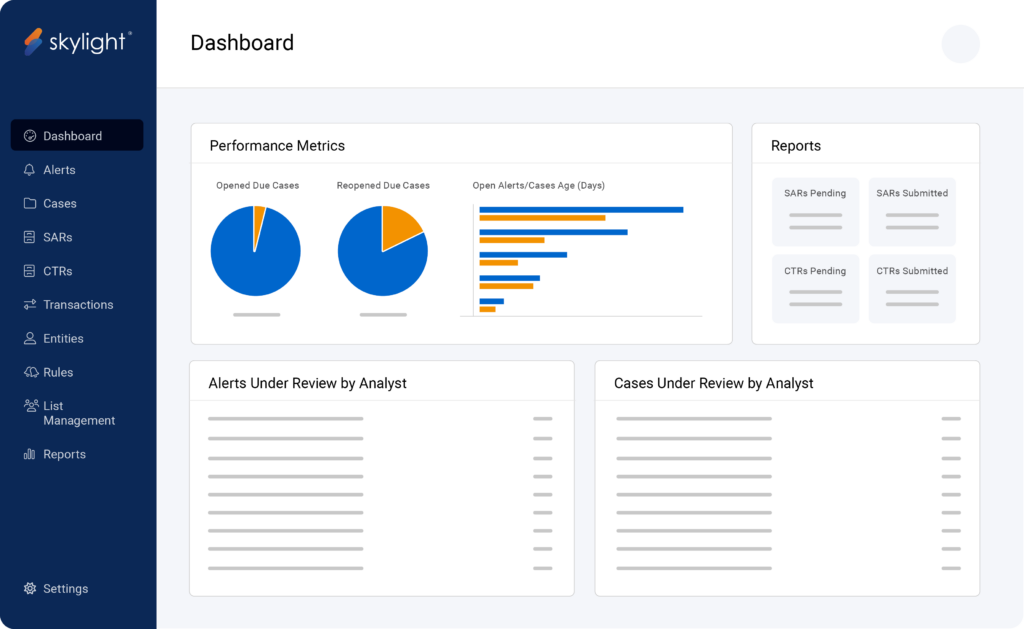

Dashboards

Make informed decisions based on real-time insights

Grow with Skylight

Unified FRAML Platform

Combine Skylight’s Case Management Module with our full suite to experience the benefits of a seamlessly integrated fraud and AML solution, including increased efficiency, holistic insights, and seamless collaboration across your risk and compliance teams.