Skylight

Skylight offers a cutting-edge compliance and risk management solution tailored for fintechs to swiftly and effectively enhance their AML and fraud detection programs. By leveraging Skylight’s advanced AI-powered tools, you can stay ahead of emerging threats and ensure compliance, all while focusing on your core business operations.

With Skylight’s no-code, user-friendly interfaces, you have the power to easily manage compliance and risk according to your unique business needs, ensuring your business remains agile and compliant in a fast-paced environment.

Book a demo

Empower Your Risk and Compliance Programs

Discover some of Skylight’s many innovations that revolutionize AML and fraud management for the fast-paced fintech industry.

Modules

Learn more about our comprehensive offering

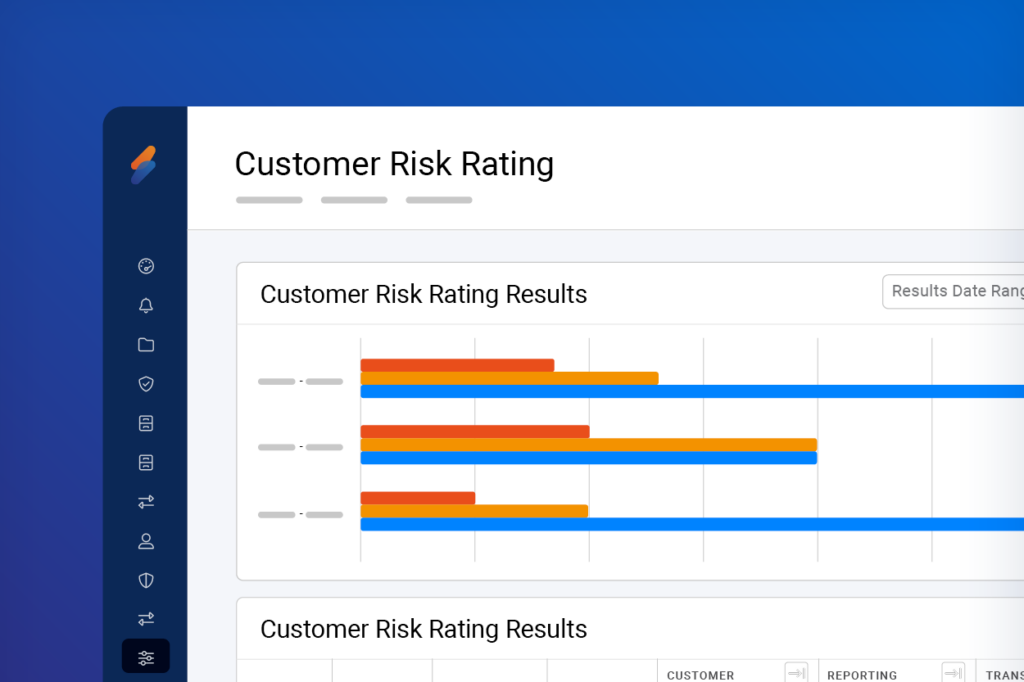

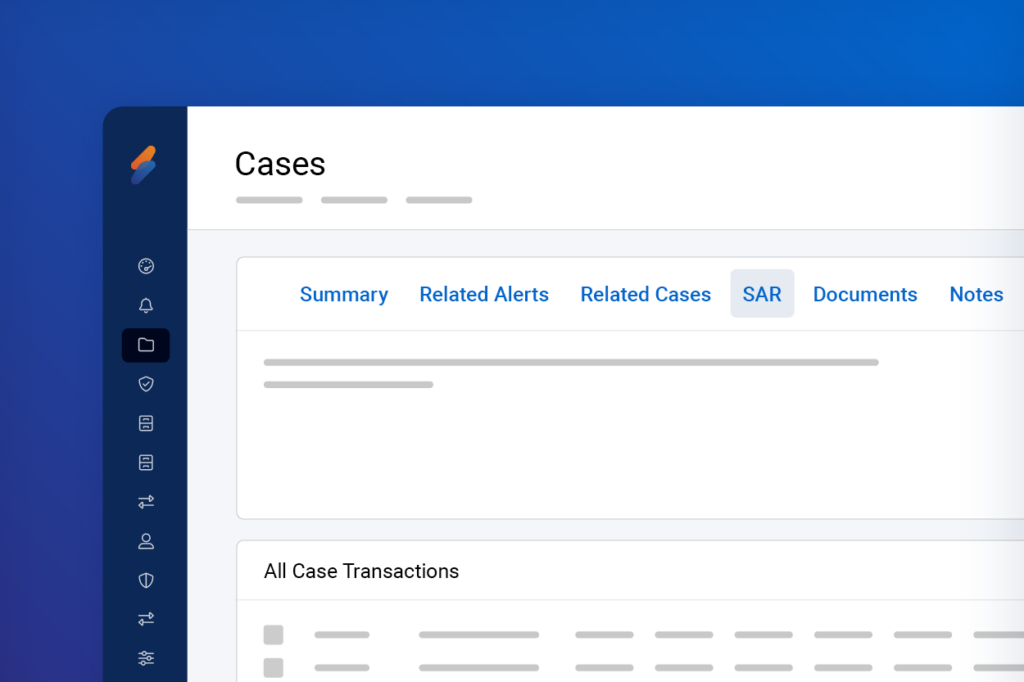

End-to End Case Management

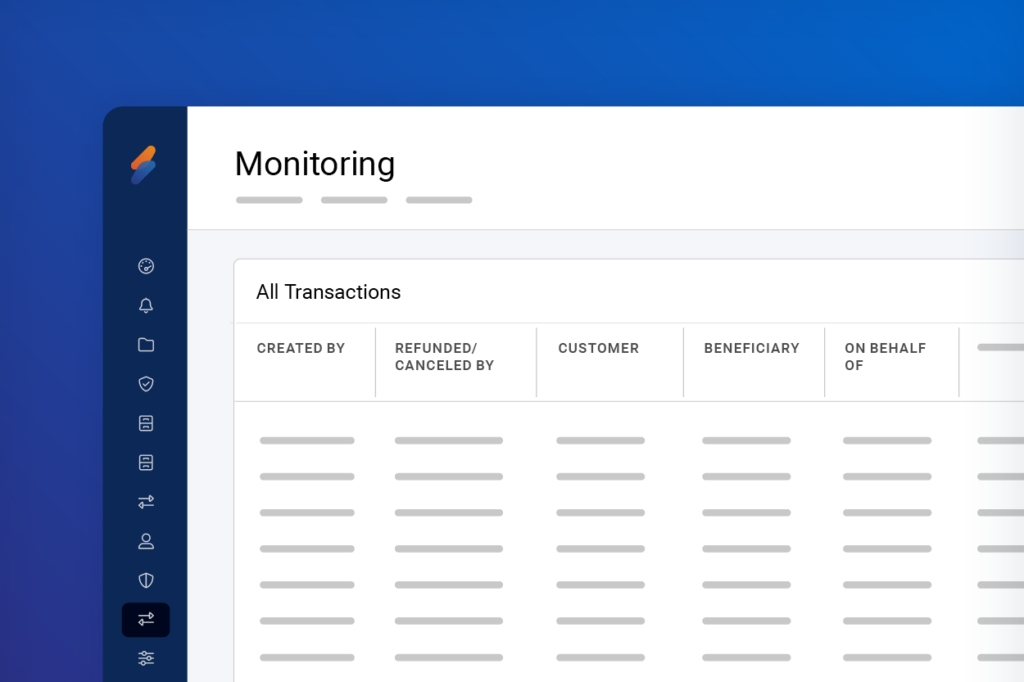

AML Transaction Monitoring

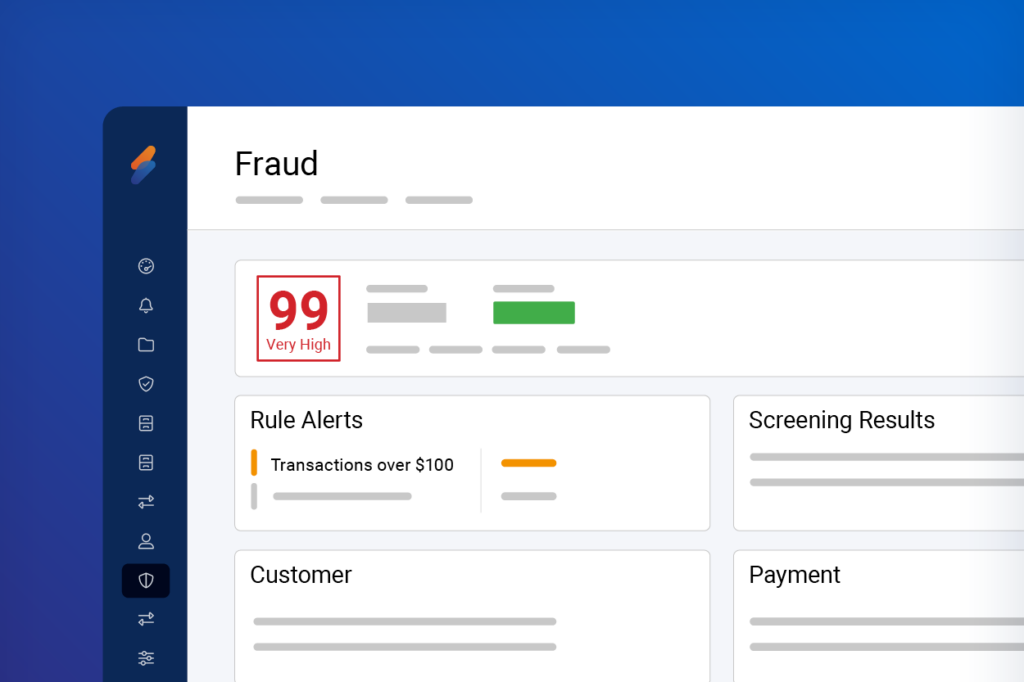

Real-Time Fraud Detection